Apply for a simple tax return online!

♣ Taxation of working holiday makers – appeal

On 26 November 2019 ATO appealed to the Full Federal Court against the Federal Court’s decision in the matter of Addy v Commissioner of TaxationExternal Link. The decision could impact working holiday makers who are a resident of Australia for tax purposes and are from:

Chile, Finland, Germany, Japan, Norway, Turkey, United Kingdom

♣ What this means for you

Working holiday maker income tax rates will continue to apply at the 15% rate (regardless of whether you are a resident or not) until the appeals process has ended. If the decision of the Federal Court is found to be correct, and you were also a resident of Australia, you may be entitled to a refund of Australian tax paid on your working holiday maker income.

For Working holiday makers (417 working Holiday or 462 Work and Holiday)

- If you work in Australia, tax will be withheld from your pay and you may need to lodge a tax return each year.

- The requirement to lodge a tax return will depend on how much income you have earned during the year.

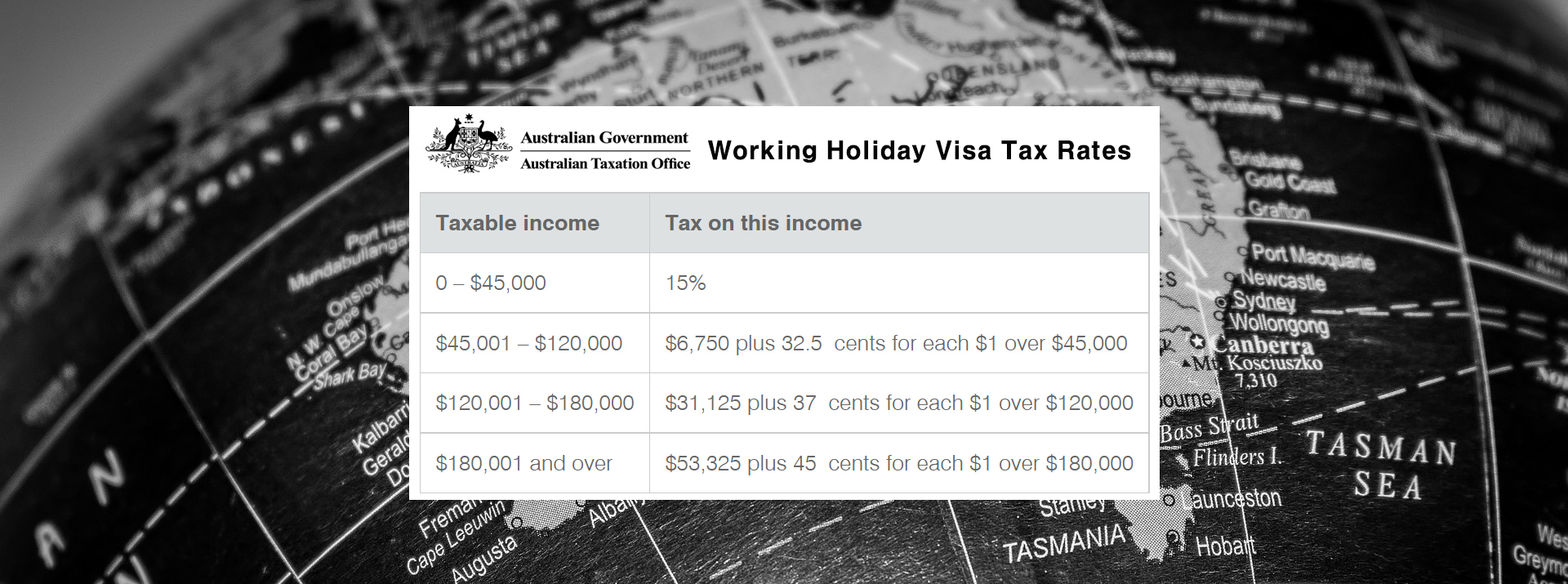

- As a working holiday maker, the first $45,000 of your income is taxed at 15% and the balance is taxed at ordinary rates.

- You are required to lodge an income tax return if your taxable income for the year was more than $37,000 and if you carried on a business.

- Also You need to tax return for intention of visa or applying for new visa.

- When ATO audit about tax return history, if you do not, penalty ($700-$1,200) will be charged for failure to lodge Tax return individuals on time.

♣ There are 2 cases based on income and tax rate.

Our Fee Is Australian The Lowest Fees

Standard Package $50

- Tax return (report income and tax)

- service for providing NOA from ATO

ABN +TFN Income Package $80

- Tax return (report income and tax)

- ABN income report

- claim for work related deduction

- service for providing NOA from ATO

Medicare Addition Fee $20

- Total gross payments over 24,500

FAQ

Most people who come to Australia for a working holiday or to visit are foreign residents for tax purposes. This includes people on visa subclass 417 (Working Holiday) or 462 (Work and Holiday) (backpackers).

To be an Australian resident you must meet one of the following:

- Demonstrate your living and working arrangements are consistent with making Australia your home.

- This usually means you have developed routines and habits in your lifestyle in Australia similar to how you lived prior to coming to Australia. You are not in Australia simply as a visitor or a tourist, but are living and working here with a settled way of life.

- See factors to consider for further information on the types of things we look at.

- Live in Australia for more than six months in an Australian income tax year, and do not have a place in another country where you usually live or intend to take up residence in Australia.

- For example, if you travel around Australia for a seven month working holiday and have a place in another country you call home to which you intend to return, you would not be an Australian resident.

The processing time of the Australian tax returns varies depending on a number of factors, including the time of year the tax return is submitted.

For the financial year ended 30 June 2013 and earlier, most refunds are being forwarded within 7-10 working days.

Our office will require a copy of your PAYG payment summary or a Statement of earnings or your final payslip.

If you have incurred tax deductable expenses in relation to your employment and you have kept the receipts, just tally them and list them