♥ Medicare levy exemption:

You can apply for Medicare levy exemption if you do not apply for PR visa. (over $24,500 income only) Also you will get more tax return and will be from $100 ~ based on your income. (=tax of Medicare levy)

You can apply for Medicare levy exemption if you do not apply for PR visa. (over $24,500 income only) Also you will get more tax return and will be from $100 ~ based on your income. (=tax of Medicare levy)

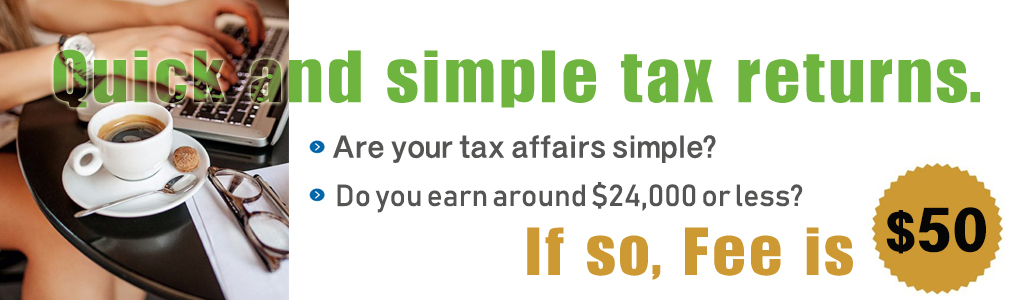

– Total gross payments less than $23,500 / – A total of less than $300 in deductions.

– Total gross payments over 24,500 / – A total of less than $300 in deductions / – Except Capital Gains, Rental, and Business

Our service fee is the lowest so you need to pay fee in advance.

However if you like to pay fee from refund, charge ($10) of bank account will be applied.

On basis of your tax papers and information, Accountant will do quick calculation and send you figures for lodgement. If you are not satisfied with the refund figures, you can always refuse to go ahead and we won’t charge you anything.

Just email us some details – Full name, Date of birth, Tax file no and Mobile no and Accountant will search Tax Office records for your Group Cert for current and previous years.

No Need of personal visit. Just email/fax your tax papers & wait for Accountant call. Accountant will answer all your queries, maximize your deductions and email you FREE tax refund estimate with option of same day tax refund.

If you want to visit and do tax return in our office, our fee would be from $65.

After your confirmation of lodgement, we will process your tax return to ATO.

It takes 7 ~ 14 days (business days)

Last date is usually 31 Oct of each year.

However, if you have not lodged so far, then you must lodge immediately to avoid tax office audit and penalties.